Australian accounting firms will witness a sea change in the coming 5 to 10 years. Cloud-based services and automation tools will disrupt the business model. It is imperative for every accounting firm to invest in advanced cloud-based systems sooner rather than later. Studies show that cloud based firms add five times the amount of clients compared with traditional firms, and report the highest growth. With the rapidly changing business environment, cloud technology allows your accounting firm to reinvent your way of work, evolve quicker and differentiate your service offerings. Here are 11 reasons why:

Accuracy

Cloud-based applications connect to external software and reduce the possibility of errors involved in manual feeds.

Enhanced security

Cloud systems have robust security protocols. They have much deeper pockets for firewalls and highly sophisticated intrusion prevention systems in place.

Cost savings

When you take into account the hardware, utility, software license, maintenance, and productivity costs, cloud subscriptions turn out to be more affordable. This is especially true for accounting firms who work with small and medium businesses. They also save time and improve the overall productivity of your firm.

Collaboration

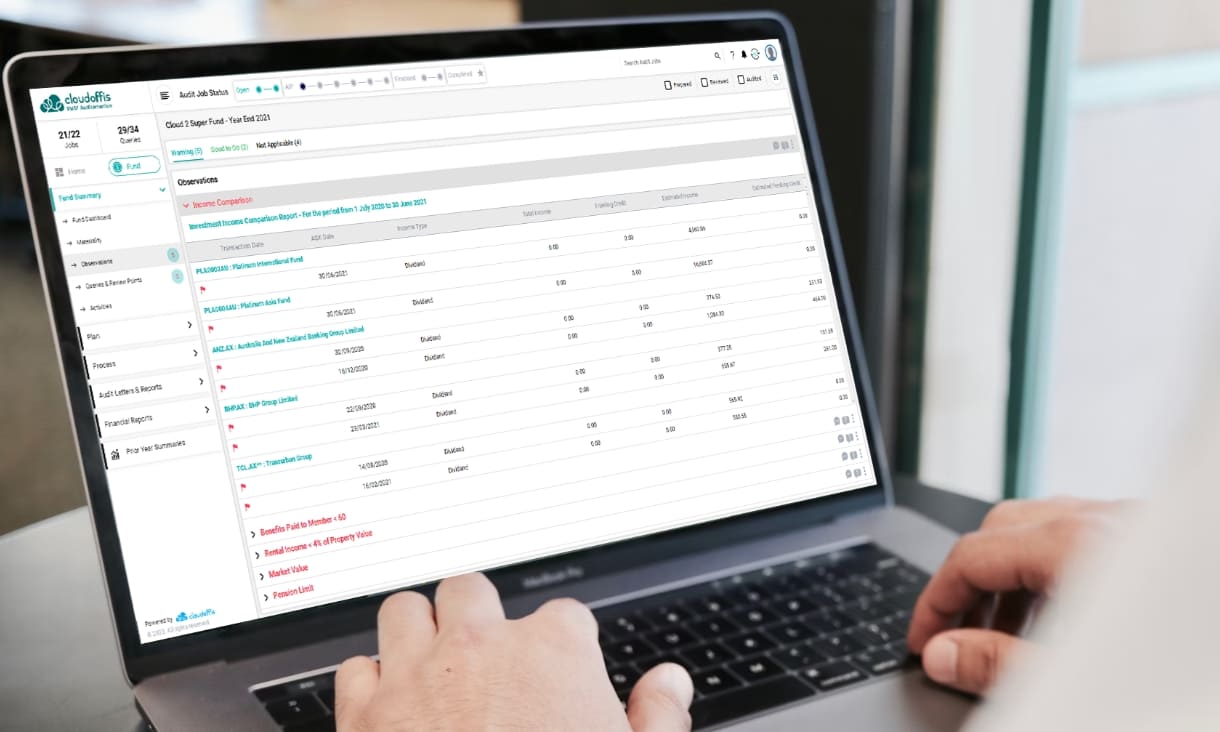

Cloud-based platforms allow you to invite clients on online platforms. Allowing online access to clients is now more imperative than ever before – especially when it comes to offering SMSF-related advice. If you don’t, they will soon move to a firm who will.

No more maintenance headaches

Updates in software and hardware are done automatically. This means your systems are always up to date, and there’s no downtime due to system related issues.

Scalability

Cloud systems allow you to expand and grow faster without increasing immediate technology costs. It allows to upscale or downscale your existing resources as per your business needs.

Efficiency

Cloud technology allows to concentrate on your core competencies while leaving the task of running IT infrastructure to the cloud service providers.

Real time financial management

With accurate real-time data at your fingertips, firms can share the golden nuggets of information with your clients. This allows you to become your clients preferred adviser and increase revenue.

Flexibility

Cloud systems give you the flexibility to access your files and data even when you are off-site or at home. You and your employees can have a virtual office wherever they go through web-enabled devices.

Added value

Moving to cloud-based technologies allows you to automate low-value tasks. This helps you add real value to your clients business and create a certain stickiness to the client-firm relationship.

Robust Data Management System

Cloud technology has in-built off-site data management. Since all the data is stored in the cloud, it’s easy to have a backup or restore it. This also means, you can access any of the audit or accounting documents whenever you need them.

The cloud is here to stay and early adopters will benefit significantly in the long run. In order to survive and succeed in an automated future, accounting firms need to go beyond a service-oriented approach and start acting as advisers for their clients by deploying cloud technologies.